3 things to ask before building next year’s budget.

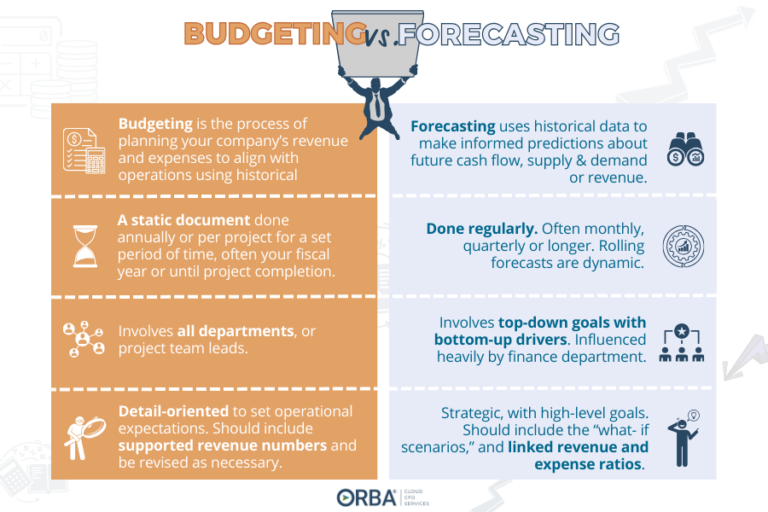

It’s budget-planning time. After a year that may very well have derailed your budget, and despite how begrudgingly you might enter this process, now is the time to plan next year’s budget. Digging deeper into the essential questions from budgeting and forecasting for high growth companies is a great place to start.

Related Read: 5 steps to building your budget.

Creating Next Year’s Budget

What key assumptions are we making?

Begin the budget process steps by being honest about what you can assume for the year ahead and plan for multiple scenarios. Has the COVID landscape changed your market and is it likely to continue to affect your market? Take into account your supply chains, liabilities, and any loans coming due along with the limitations on your assets. Depending on your business model, you will have different revenue drivers to budget for. More accurate assumptions can be made with well-rounded, company-wide input. Don’t forget to also prepare for inflation. Using the basket approach, compare your profit margins from this year to last year and adjust accordingly.

Cloud CFO Tip: Set top-down goals but ensure reasonableness from the bottom. Your tactical managers can help with this. For more accuracy and buy-in, involve the right members of your team who have a good sense of operations, sales and business development and understand the current market trends.

Will we have the needed cash flow?

The question of the hour. Remember that your profit and loss statement (P&L) does not equal cash flow. Review your accounts receivable, accounts payable, inventory, fixed assets and deferred revenue.

Cloud CFO Tip: Start with your statement of cash flows and then work backwards through your balance sheet and P&L. As you begin budget planning, set yourself up for success by asking your controller for your cash runway and burn rate. Liquidity, current and quick ratios can help give you insight into your cash flow and financial health.

What are our drivers of growth?

Finally, focus on your growth drivers. Begin with budgeting your revenue drivers then move on to budgeting expenses. The most important are your cost of goods sold (COGS) and variable costs. Finally, work through your semi-fixed expenses, taxes and depreciation and amortization.

In this post which includes the 5 steps to building a budget, manager, Carolyn Koonce, recommends that clients “DO get detailed in their biggest drivers, which are usually income, COGS [cost of goods sold], and personnel expenses. Budget salary by person rather than a flat percentage across all positions. Think about if any positions will need to be added in throughout the year to sustain the growth you’re predicting. Then stay high-level on the less impactful things. Instead of listing out each supply need per department, include a general percentage increase and move on!”

Cloud CFO Tip: Don’t spend time drilling down items like staplers and office supplies, but do be detailed when budget planning growth drivers and break them down to the smallest key metric (e.g. 20 new customers each month = one new hire, or 2,800 widgets sold).

A quick reminder, creating a budget is valuable because it forces your business to plan. Your budget is simply a stake in the ground to use as a reference point for forecasting and strategizing. You could be way off and that’s okay.

More reading to plan for next year’s budget:

Reviewing and Revising the Budget

Now that you’ve finished planning next year’s budget, don’t forget to review and revise. While traditionally, budgets are made with backward-looking financials and unlinked data, we work with our clients to provide dynamic cash flow forecasts to better understand budget variances and how they can adjust. In the current financial climate this forward-thinking approach to financials becomes even more important. Need help planning your budget? Our outsourced CFO services are designed to give you just enough strategic oversight without the executive price tag. Book your free consultation today.