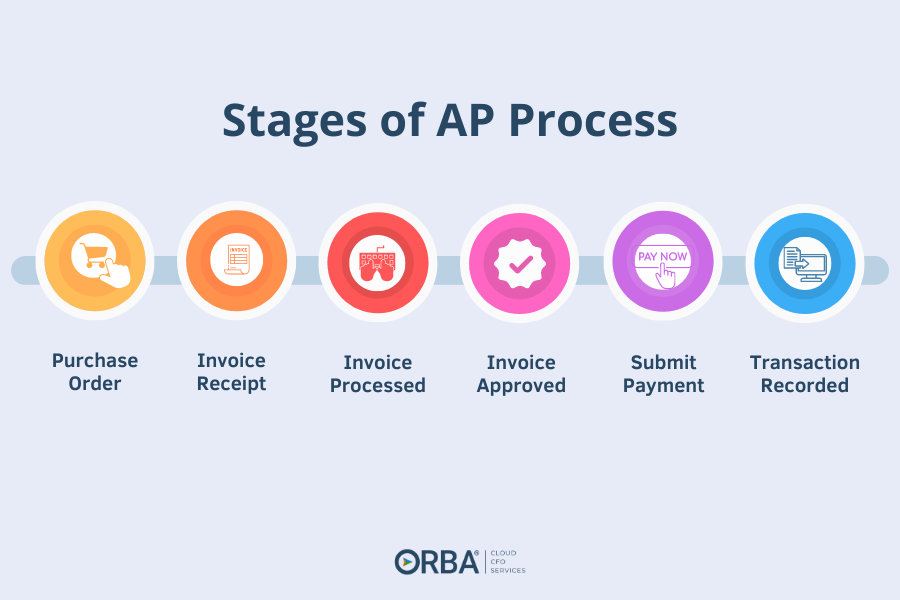

The AP Process: A Step-by-Step Guide to Accounts Payable

You know what’s not awesome? An outdated, time-consuming AP process. You know what is awesome?

An efficient Accounts Payable (AP) process that saves your staff time and your business money.

Not only does a dialed AP process make sure your bills are paid on time; it strengthens your connections with vendors, and keeps you in line with regulations, but it also forms the foundation for financial stability and growth.