Now is a better time than ever to get your business spending under control. Unlike most accountants, we like to focus on growing your business but certain times call for cost-cutting measures. Better yet, if you can cut your monthly business expenses as you’re growing then you’re creating a great capacity to scale.

How agile is your budget? Did you build in any contingency plans or room for flex? If not, as a business owner in a post-pandemic, inflation (possibly stagflation?) climate you may be looking at a need to reforecast completely and defer expenses where possible. Whether you’re hoping to cut business spending or looking to build capacity to scale, here are six easy-to-grasp strategies to cut your monthly business expenses.

6 strategies to cut business expenses when growing your business.

1). Update Your Expense Policy

If you haven’t yet, now is the time to create an expense policy. Support your standardized procedures with things like a schedule and a list of qualified expenses. Revise these lists to further curb spending in unpredictable financial climates.

2). Transparency with/Educate Your Team

With transparency comes responsibility and accountability. When employees know what’s on the line it becomes easier to rally them. Avoid burdening them with the full financials of the company, instead focusing on the line items they can control.

“Ask your staff: ‘you spent this amount on office supplies last quarter, what can you do to be creative and cut this by 10%?'”

For example, “you spent this amount on office supplies last quarter, what can you do to be creative and cut this by 10%?” If you’re the CEO there are only a few areas that are going to warrant your time to spend looking at. But for other people in the company an expense item might be 100% of their world. This approach builds accountability and a feeling of having an effect on the company. Even if it doesn’t hit the bottom line, if your employees can find a cost savings of 20%, then celebrate the win. For employees who are curious and want to learn they’ll likely want to dive right in.

3). Review your Personnel Structure.

Wait! We’re not going to tell you to lay people off.

Examine administrative roles for efficiency and effectiveness. For example, if you have clerks on staff that spend time entering data for reporting purposes, scrutinize the usefulness of those reports and consider whether those reports could be automated. But we’re not suggesting replacing people with tech, instead increase efficiency within that team to create a capacity to scale. Pay the one-time implementation fee for that automation instead of hiring more staff and you’ve freed up time in your clerk’s day to take on more tasks.

Additionally, if there has been little turnover in your team, the supervision requirement of management roles should lessen each year- look to fill those gaps with tasks that have a direct return on business development.

Cloud CFO Tip: Fill gaps in management roles with tasks that have a direct return on business development.

Finally, if you are planning to hire but wish to continue cutting your expenses, you might want to outsource to save on benefits and associated overhead costs. Our experience with clients indicates that outsourcing reduces administrative costs while simultaneously improving performance. Alternatively, you might look to merge roles to take on more responsibility for a raise. Compared to hiring a full-time employee, this is still a savings.

Related Read: Four Signs it’s Time to Outsource Your Accounting.

4). Swap Fixed Costs for Variable Costs

To get creative with your cash flow, ask your controller where you can swap fixed costs for variable costs. For example, reducing fixed salaries of your sales team by offering them a higher sales commission can be an attractive offer to your A-list salespeople. For service-based companies, you might employ contractors to swap fixed costs for variable costs.

Here’s a great example: After performing some financial clean up for a newer client, we noticed some staff were being underutilized. When the employees were working directly on a job, their salary cost gets moved into COGS. Anytime the same staff sat idle we moved their salary costs into an account in the overhead section titled “underutilized employee salary”. We quickly realized they were accumulating $20,000 in unused salary costs every month. In a people business, you might expect a one-off month where employees aren’t fully utilized; but, if it’s a consistent issue then you’re not staffed properly. That’s money you’re tossing out the window (or into people’s pockets, without any return at least).

Cloud CFO Tip: Watch for underutilized employee costs.

Instead, in a case like this, hire staff to cover 50-75% of your expected workload- or whatever you can consistently maintain. Then utilize contractors to make up the remaining percentage if you get more work, i.e., revenue. Trust me, you’ll sleep better at night. Contractors are available to hire if needed and you don’t have to worry about letting people go if the work isn’t there. While you’re giving up some gross profit margin on the incremental work during the higher revenue months when you flex up, when you have a bad month, you’re not stuck paying fixed salaries for staff simply because you don’t want to let them go.

Another alternative is to pay overtime to your current team instead of hiring subcontractors when you flex up. It’s a win-win, they make more more money and you still pay less than you would contracting out. In general, overtime is a useful solution across industries not just those that use contractors.

5). Involve Managers in Building Your Budget

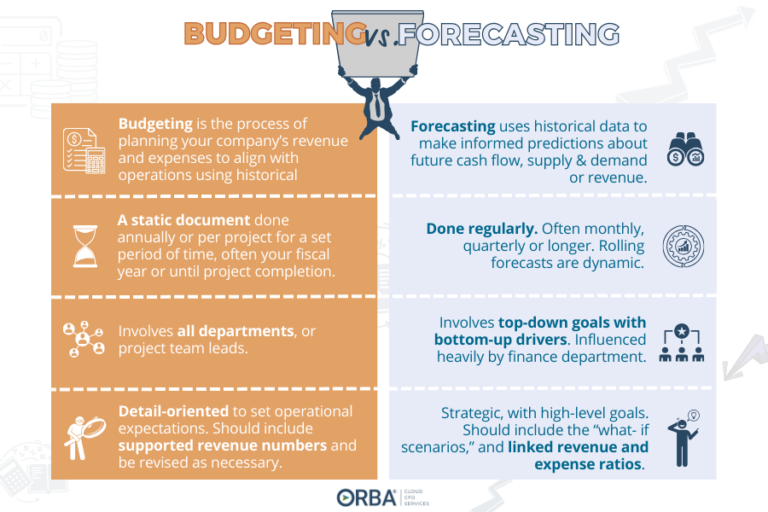

Bring in your tactical managers from each department to adjust your budget for growth. Additionally, by shifting to a zero-based budget you identify and isolate which expenses are most essential to your operations. Really dig into anything you may have dubbed “miscellaneous expenses.” Anything else, you can consider cutting or deferring temporarily. I talk a lot about how a budget is a stake in the ground. It’s not really a great standalone document after the first month it’s been made. Instead, use your budget as a tool to build rolling forecasts to set targets for managers to work towards.

Related Read: Don’t think a zero-based budget can be geared toward profitability? Think again.

6). Review All Monthly Recurring Costs

Take a hard look at the business expenses you’re incurring monthly and determine whether they’re all essential to your bottom line and more importantly if they’re driving growth? Defer or pause subscriptions or memberships to quickly make cuts to cash expenses. Now is the time to really examine the ROI on those kinds of items.

Don’t assume that the only way to cut business expenses is to lay people off. Plus, if you’re a growing business, cutting costs can simply mean a new ability to scale profitability. And what’s more awesome than that?

Need help identifying fixed costs to swap or underutilized employee costs? Our outsourced controller services offer the financial reporting you need to cut business expenses. Get in touch to learn more.