We get it. Your business is your baby and it’s no small thing to hand over your books to a new financial daycare. We’re here to walk you through the process. We promise once it’s done you will be so happy you did. It’s a process we’ve finely tuned over the years into an onboarding machine that we believe sets us apart from the competition.

Curious about how it all goes down?

Onboarding new clients is a seamless 3-phase process with an opt-in for advanced services depending on how many additional needs the client has.

Signing on

Signing on involves contract and scope of work discussions with our director who then knowledge-shares all important information with the onboarding team.

Next, our onboarding manager will plan a kickoff meeting. New clients will receive an email with the agenda, along with things we need brought to the first, very exciting meeting. Things like: account and systems access, pass codes and login credentials and any specific procedures we need to be aware of.

We come to you, unless of course, you work from home or in a co-working space and would rather use one of ORBA’s meeting spaces. If your business or key contacts happen to be out of state, no worries, we conduct the meeting via video conference.

Phase 1: Kickoff Meeting

Introduction, Approach and Expectations and System Set Up

We typically find we have two kinds of clients: those that have some experience in accounting and finance and want to stay more involved. And those that don’t who prefer to hand everything over and rely on our best practices and schedule.

Oh, and there’s a third kind of client who we empathize with: the owner we mentioned above. The owner who has been doing everything up until now and is reluctant to hand over the books to the business they’ve poured their heart into. Let me assure you, we don’t take this process lightly. Our primary goal at this stage is to build trust and show our clients we care about their business and their success. That relationship begins from day one of onboarding.

At the kickoff meeting introductions will be made between the onboarding manager, ongoing manager and the client’s team.

A crucial part of phase one is reviewing the onboarding approach and plan, setting our schedule and establishing expectations. This is paramount to a great working relationship. We lay out the frequency of our meetings (at least once a week during the onboarding process); agree on the timing for the transition and ownership of processes; develop scheduling around reporting; clarify how much involvement the client will have; and discuss which information they need to make important business decisions. We then tailor our approach to meet those needs.

The most important aspect of the kickoff meeting: gaining access to the client’s accounts and systems. The goal is to have all the required access before the meeting ends. We want to leave fully equipped for phase 2. The transition to our services will be seamless.

Phase 2: Weekly Accounting Items

Transition of Bill Payments, Customer Invoicing and Payroll

In phase two of onboarding new clients, we cover all things that need doing weekly or biweekly:

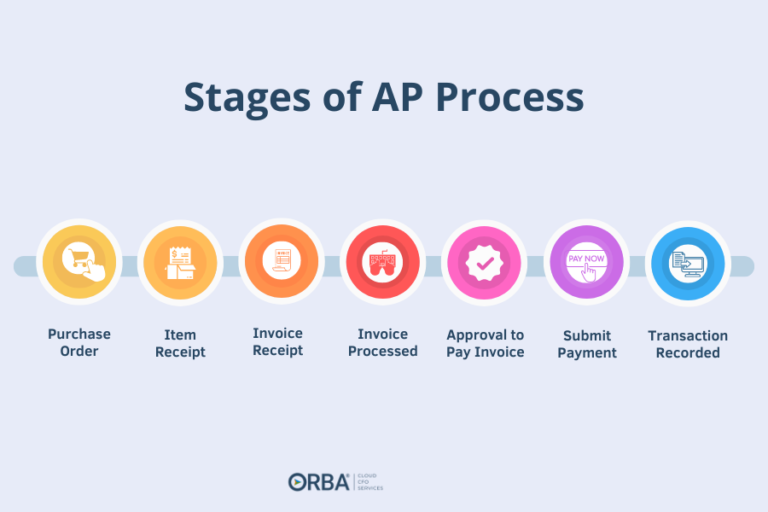

- accounts receivable (AR)

- accounts payable (AP)

- payroll

Accounting processes are standard but each client is different. We cover anything that is unique to the client and plan for that transition.

We structure each meeting around the client’s needs. At the first phase 2 meeting for each process, clients train us on their procedures. We leave the meeting with full ownership and responsibility of execution. Then we come to the second meeting with questions and clarifications on deliverables.

At every meeting we provide a status update, celebrate our successes to date and plan for future changes if needed.

Once we understand the existing procedures we then develop or make process improvements where necessary. We won’t ever make changes until we truly understand and have gone through the current process and can replicate it. All procedures are entered in our task management software, Asana, so everything lives in one place and so anyone can step in and assist. This part alone sets us apart as you will forever have all your accounting procedures meticulously documented.

Dynamic Adjustments

This is our standard approach, but if there is something more pressing to the business than getting trained on weekly items- for example, if there is an issue with AR and invoicing that needs immediate attention or a need to focus on clean-up to apply for a line of credit etc.- then we prioritize that. Onboarding is a dynamic and always changing process.

We’re continually making these adjustments as we move through phases three to five and we’re continually communicating through this process. This is one of the best parts about onboarding new clients: it’s all right at their fingertips. We get to witness their excitement because of the changes we’re making. We see the house that’s being built and want our clients to share in that vision.

Phase 3: Month-End Accounting Items

Month-End Process Knowledge Share

In phase three, we cover and learn about all items related to month-end accounting and verify their accuracy and completeness: cash and credit card and other balance sheet account reconciliations and related journal entries, AP, AR, etc.

Depending on the complexity of the month-end process, we step right in and take over, or if necessary plan for any training required. We then document the steps into Asana.

Reporting

We create balance sheet workbooks- which I find most businesses aren’t currently operating with. We learn about the current month-end reporting from a deliverables point-of-view and we talk about what reports we can provide. Usually it’s more (in quality and quantity), not less.

One of the biggest asks we get is related to cash flow reporting. Budgeting and cash flow is the focus of phase three but on a miniscule scale it’s also included with AR and AP and bill payments. Not only will we create these reports, we own them and typically update them weekly in accordance with bill pay so you have the information you need to make important decisions.

Chart of Accounts

Next, we cover the chart of accounts and reorganize as needed. Fixes to the chart of accounts will provide useful information about profitability and aid in budgeting. We complete all vamping out and adjust reports to suit the needs of the business. Needs like, reporting by department or class (product or business line), to help you make better business decisions and maximize the profitability of your company.

Once you’ve completed phases one through three, your associate is onboarded with no interruption in services. They’ve typically been trained behind the scenes throughout the onboarding process. Their focus is to maintain completion of the weekly accounting items and month-end close with direction and oversight from the ongoing manager. This allows the onboarding manager to divert their attention to higher level services.

Phase 4 & 5: Advanced services

Key metrics and other special projects.

If you sign up for the advanced services packages, then we will continue onboarding as needed with reviewing managers.

Timing

Within a week of the kickoff meeting, we’re already owning and executing upon the first process we agreed we’d take over! Typically, the total onboarding process timeline is completed within 5-6 weeks.

We’re not afraid to talk about our emotions.

As an onboarding manager, you need to have a very high emotional intelligence. I know, not something you associate with your every day accountant! And that’s what sets us apart. Our team is able to read our clients, asses their needs (e.g., do they need more details in their reports or something more high level). I genuinely consider our clients’ anxieties and what’s keeping them up at night… at least from a business perspective. We aim to address all of those concerns, predict what they need and deliver without them ever needing to ask.

Because we listen so intently, we often learn things in the onboarding process that may need addressing or extra help, and because we’re embedded in a full-service accounting firm if we ever encounter something outside our realm of go-to services we can easily access expert tax advice, audit advice, and GAAP compliant advice, to name a few examples.

I am reluctant to say this – only because I’m the onboarding manager – but I think what makes our onboarding truly unique is our people. Our onboarding process and procedures could be duplicated but the people executing them cannot. Emotional intelligence and empathy are traits that transcend process and procedures. We believe genuine care for our clients and believing in the success of their business is what ultimately sets us apart.

The expert accounting team you've been looking for.