The Most Common Signs You’re Outgrowing QuickBooks

We often get asked by companies whether or not they are outgrowing QuickBooks. Let’s just say the honest answer is—it depends.

It depends on your company size, it depends what industry you’re in, and it depends how quickly your company is growing… you get the picture.

Another disclaimer: We love QuickBooks. We use it for plenty of our clients. When new clients approach us with a free accounting system, the first thing we do during our onboarding process is move them over to QuickBooks Online (QBO). But, it does have its limitations. Don’t have an awesome accounting firm to tell you it’s time to make the switch from QuickBooks?

When is it time to take the next step up from QuickBooks?

Here are 5 common signs to know if you are outgrowing QuickBooks:

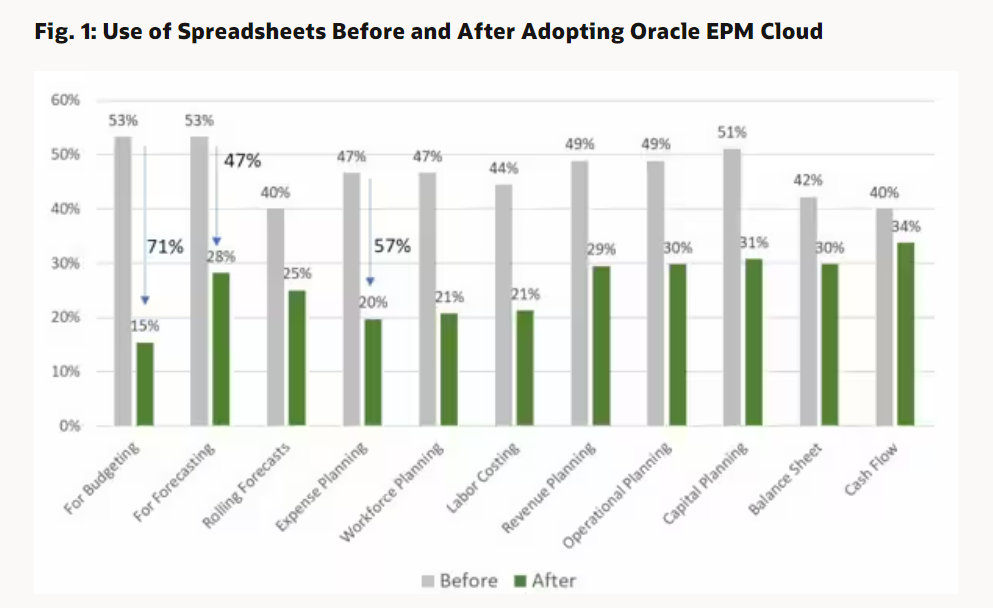

1). You’re consistently using other programs (most often Excel) to build reports.

This is probably the number one reason companies begin to realize they have outgrown QuickBooks. Intuit is constantly working at providing better reporting options within QuickBooks Online, but it still doesn’t meet all reporting needs.

2). Your company has multiple entities or receives revenue in multiple currencies.

QuickBooks has serious limitations around its capabilities to handle a growing organization. You have outgrown QBO if you have multiple entities or a have expanded services or products worldwide. If your company gets paid in multiple currencies, we recommend converting to more robust software. While QuickBooks does have the setting for Multiple Currency, it’s limited if you need to roll up everything within one QuickBooks company.

3). You have a large and varying supply of inventory.

QuickBooks Online isn’t built for large amounts of inventory that come from a multitude of sources. QuickBooks Desktop does a better job of handling inventory needs, but ultimately if you have large inventory turns or landed costs, if you need inventory forecasting, lot tracking capabilities or if you have multiple ID codes for your products, you have likely outgrown QuickBooks.

A word of advice: if you have reached a stage of growth where your business needs any of the above list, do not start using Excel in lieu of finding a long-term solution. It may seem like a cost-saving remedy, but you will save time and money in the long-run by setting yourself up with an ERP that offers many integrations like NetSuite, for example.

Related Read: 8 Benefits of ERP Systems

4). You’re worried that your internal controls may not be up to par.

If you’re wanting to mitigate your risk against audit or fraud, QBO might not be the right choice for you. Intuit still hasn’t provided a way for users to back up their data or to restore their files if something gets corrupted. This is a huge risk for inexperienced QBO users who may have a higher likelihood of accidentally corrupting or deleting transactions.

5). Everything is taking longer than it should: entering transactions, creating bills, pulling reports, data entry.

Finally, if you’re finding that everything you do related to your books is taking a significant chunk out of your day, it’s probably time to move to a more robust system. Or better yet, consider an ERP and some NetSuite accountants.

Does any of the above sound familiar? If so, then there’s a good chance you are outgrowing QuickBooks. You can prepare for the transition to a new system by ensuring your data in QuickBooks is up to date and accurate.

Did you answer yes to any of the above? Are you thinking about making the switch to NetSuite? As NetSuite BPO Partners, we’re experts in helping with a NetSuite implementation and outsourced NetSuite bookkeeping services.