FOR ADDITIONAL CLARIFICATION ON FORGIVENESS OF OWNER-EMPLOYEE PAYROLL COSTS, PLEASE SEE OUR JUNE 24 CLIENT ALERT

On June 17, 2020, the Small Business Administration (SBA) issued updated guidance to reflect the Payroll Protection Flexibility Act. The SBA also provided a revised PPP loan forgiveness application, Form 3508 and instructions, along with a simplified Form 3508 EZ and instructions for qualified borrowers.

Form 3508 EZ reduces the burden on applicants, but can only be used by borrowers that:

• Are self-employed with no employees; or

• Did not reduce salaries or wages of their employees by more than 25% and either:

• Did not reduce the number of hours of their employees; or

• Experienced reductions in business activity as a result of health directives related to COVID-19.

The applications and instructions, along with the new guidance, clarify several items. The Covered Period is now the 24-week period beginning with the PPP loan disbursement date. However, borrowers that received the PPP loan funds before June 5, 2020 may elect to use the original 8-week period instead. In no event may the Covered Period extend beyond December 31, 2020.

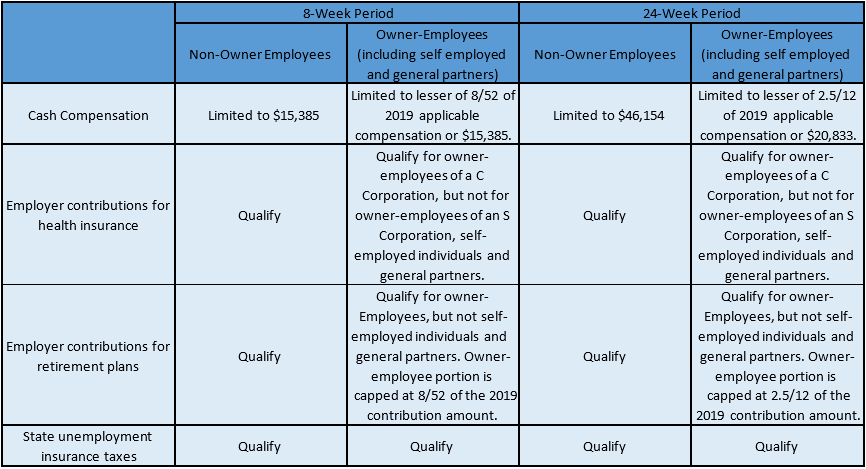

Eligible payroll costs have been more clearly defined as described in the table below:

FOR ADDITIONAL CLARIFICATION ON FORGIVENESS OF OWNER-EMPLOYEE PAYROLL COSTS, PLEASE SEE OUR JUNE 24 CLIENT ALERT

Also, the requirement that 60% of the loan be used for qualified payroll costs has been softened to be a limitation on forgiveness, not a cliff that if not met would result in no forgiveness.

It is also clear that only PPP loans received on or after June 5, 2020 will automatically receive the five-year payment term. The two-year term remains in effect for loans made before June 5, 2020, unless both the borrower and lender agree to extend to five years.

If you have not yet applied, the application deadline to obtain a PPP loan remains June 30, 2020.

Other forgivable expenses, including qualified rent, mortgage payments and utilities, remain and are more fully discussed in our previous Client Alert, Paycheck Protection Program: Loan Forgiveness Application Released.

Related Read: Paycheck Protection Program: Loan Forgiveness Application Released

The Treasury and the SBA continue to update, change and clarify the guidance related to the PPP Loan Program. Your ORBA advisor is available to assist you through this complex process. If you have questions regarding this Client Alert or if we can be of assistance in helping you through the application or forgiveness process, please contact Frank Washelesky at [email protected] or your ORBA advisor.

Related Services

Related Industries

Dental

Health Care

Law Firms and Lawyers

Manufacturing and Distribution

Not-For-Profit

Real Estate

Restaurant